billionloans have developed a simple digital lending solution to address the common challenges faced by suppliers without impacting existing payables processes of large Anchor Clients. In addition, the supplier will be able to leverage a wider set of banks, get quicker turnaround for set-up and avail a host of MIS reports and a Dashboard

BILLIONLOANS OFFERS A CONVENIENT, EASY TO USE SOLUTION FOR YOUR WORKING CAPITAL MANAGEMENT PROBLEMS

THE WORKING CAPITAL PROBLEM

The cost of credit is higher for suppliers like you than for your customers.

As your sales grow, your business needs more finance but your lenders

take time to increase your limits.

Customers always ask for more credit,

which results in a lot of your funds getting tied up in receivables.

As your transaction volume increases, you are spending

more time and resources managing invoices.

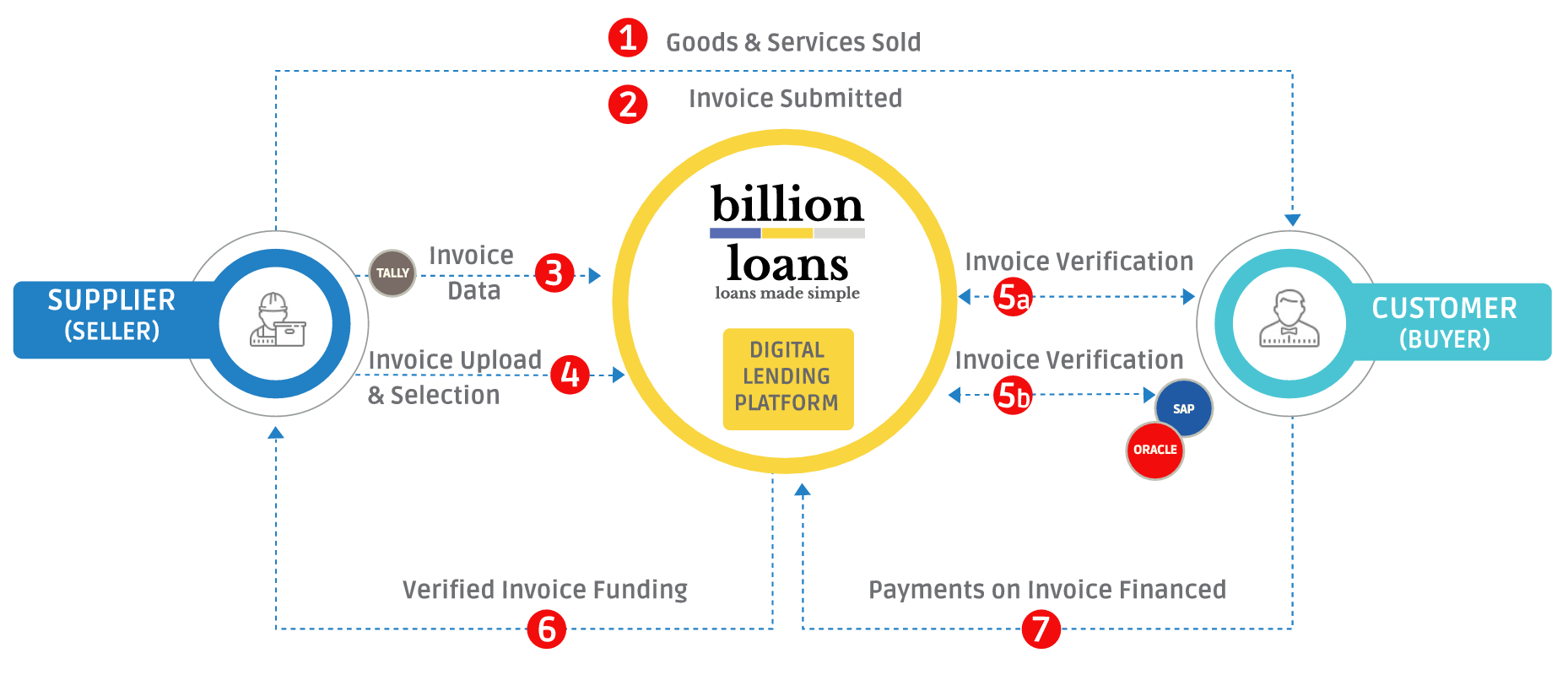

HOW IT WORKS

Solution and Offering architected towards creating an

ecosystem that provides businesses proactive cash flow

management using three key parameters – supplier

payments plans, buyer payment record and supplier

credit.

Lending platform will provide customers low-cost,

fast and reliable access to finance, and will employ

advanced adjudication methods and streamlined

processes.

ADVANTAGES

Paperless

Transaction processes are digital and straight

Pricing

Based on credit appraisal of supplier

No Waiting

Financing available at pre-invoice approval stage based on relationship with Anchor

- Simple Invoice Discounting Process using our automated solution for uploading invoices on to our platform.

- Borrow at competitive rates, without collateral, using our network of empaneled lenders.

- Easily manage your invoices, track payments and delays using our invoice management tool.

- Enjoy the security and reliability of our cutting-edge Blockchain based platform.